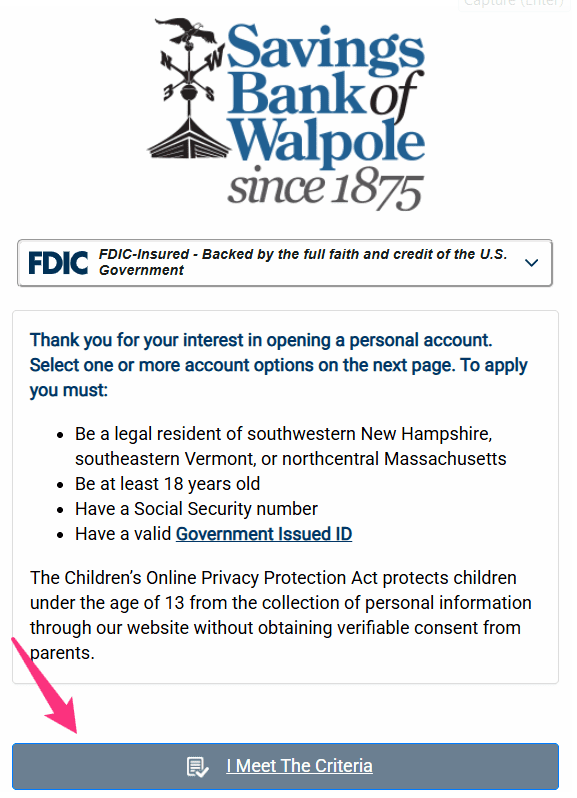

What you’ll need:

- Valid Government Issued ID

- Social Security Number

- Live in Southwestern NH, Southeastern Vermont, or Northcentral Massachusetts

Steps to Open an Account Online:

Step 1:

After ensuring you meet all the requirements, click the “I Meet The Criteria” button:

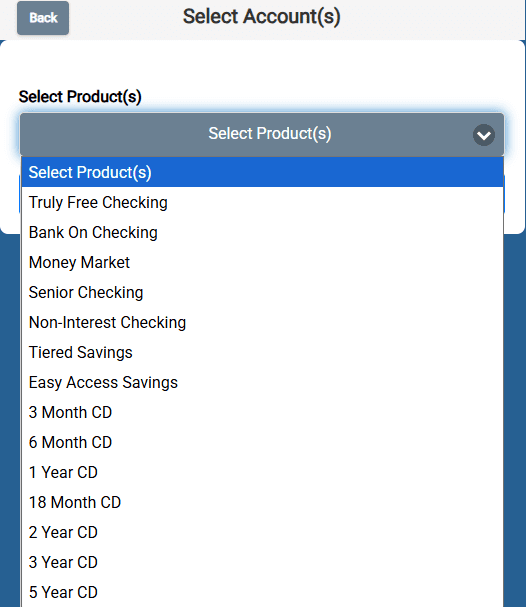

Step 2:

Next you’ll want to select which product you want from the dropdown.

If you aren’t sure, here’s a breakdown of the differences between each:

| Checking Account Name | Benefits | Requirements |

| Truly Free Checking | -No monthly service charge -Complimentary debit card | -$10 minimum deposit to open -$100 minimum daily collected balance to earn interest |

| Bank On Checking | -Certified by Bank On as meeting National Account Standards for safe and affordable bank accounts -No monthly service charges -No overdraft fees -Full access to online and mobile banking | -$10 minimum deposit to open |

| Senior Checking | -No monthly service charge -Complimentary debit card -Standard checks at no additional charge/50% off other styles | -$10 minimum deposit to open -$100 minimum daily collected balance to earn interest -Primary accountholder must be at least 62 |

| Non-Interest Checking | -No monthly service charge -Complimentary debit card | -$10 minimum deposit to open |

| Savings Account Name | Benefits | Requirements |

| Tiered Savings | -No monthly service charge -Free personalized deposit/withdrawal slips | -$10 minimum deposit to open -$100 minimum daily collected balance to earn interest |

| Easy Access Savings | -No monthly service charge -Complimentary debit card | -$10 minimum deposit to open -$100 minimum daily collected balance to earn interest |

CD Accounts all have a $500 minimum deposit to open and to earn interest. Early withdrawal penalties may apply. Take a look at the terms and rates to choose the option that is right for you:

All rates effective Thursday, February 5, 2026 unless otherwise noted and are subject to change without notice.

| Interest Rate | Annual Percentage Yield (APY) | Minimum Balance to Obtain APY | Minimum Deposit To Open | |

|---|---|---|---|---|

| 3 Month | 0.10% | 0.10% | $500.00 | $500.00 |

| 6 Month | 3.45% | 3.50% | $500.00 | $500.00 |

| 1 Year | 3.20% | 3.25% | $500.00 | $500.00 |

| 18 Month | 2.96% | 3.00% | $500.00 | $500.00 |

| 2 Year | 0.30% | 0.30% | $500.00 | $500.00 |

| 3 Year | 0.40% | 0.40% | $500.00 | $500.00 |

| 5 Year | 0.45% | 0.45% | $500.00 | $500.00 |

$500 minimum to open. A substantial interest penalty may be required for early withdrawals from Certificates of Deposit and IRA CDs. Contact a representative for further information regarding applicable fees and terms. Fees could reduce the earnings on the account.

If you withdraw any of the principal before the maturity date, we may impose a penalty. CD accounts will automatically renew. You will have 10 days after the maturity date to withdraw funds without penalty. If you do not withdraw the funds, each renewal term will be for an identical period of time as the original term.

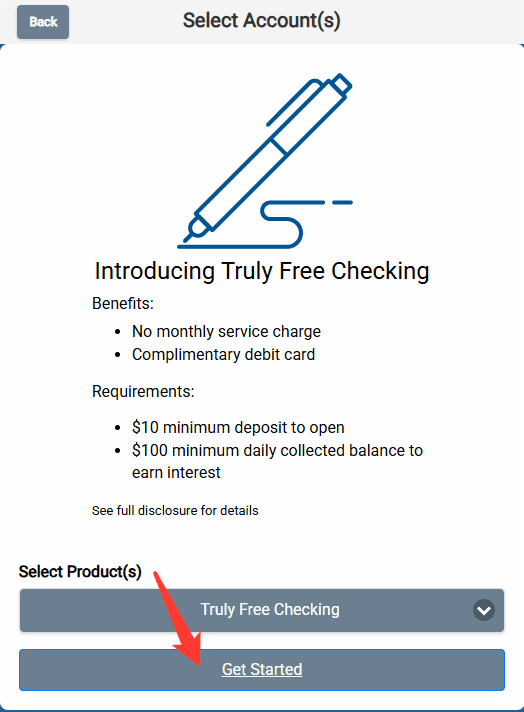

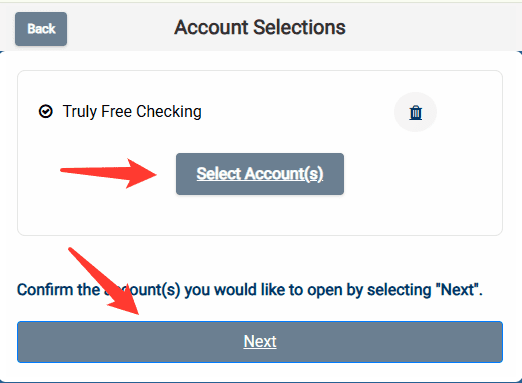

Step 3:

Once you’ve chosen your account(s) click the “Get Started” button.

Step 4:

If you need to open more than one account at once you can click “Select Account(s)” to select more options, otherwise click “Next”

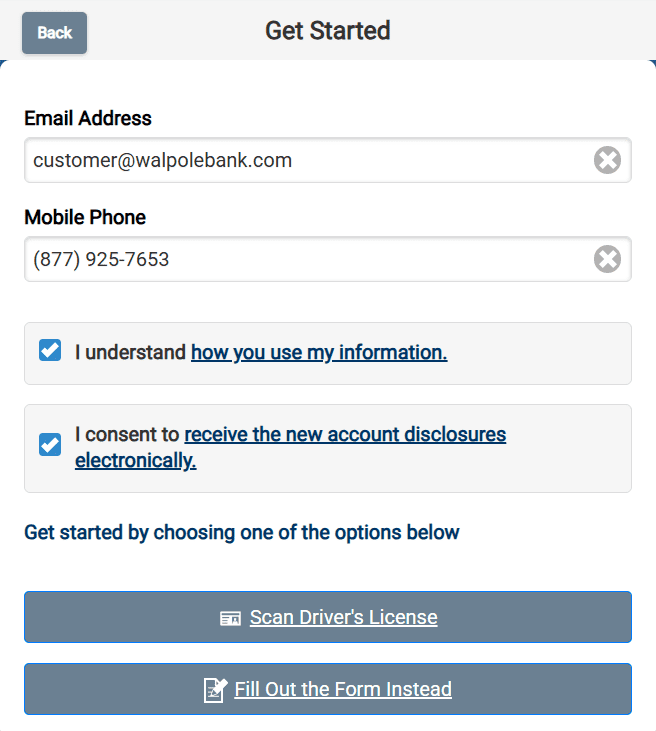

Step 5:

Fill in your email, phone number and check both consent boxes.

*Two different codes will be sent to your email and phone. Use the phone code to verify your account. Save the email code for later. If you did not receive both codes, you can try to resend. If you still don’t get it, we’d recommend you contact us for help or visit a branch.

Step 6

You can choose to scan your license or start off with the form. If you choose the license you will be prompted to take a photo of the license front and back. At any point during uploading your license you can chose to fill out the form instead.

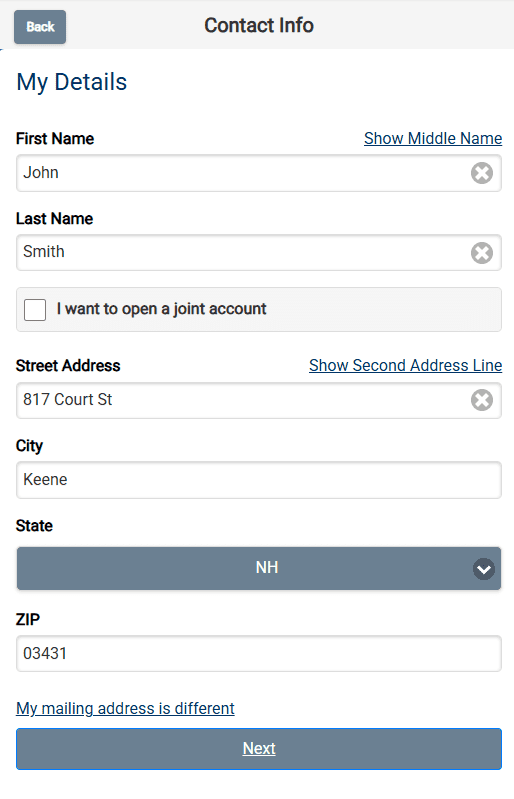

Step 7

Enter your Contact Information, then click “Next”

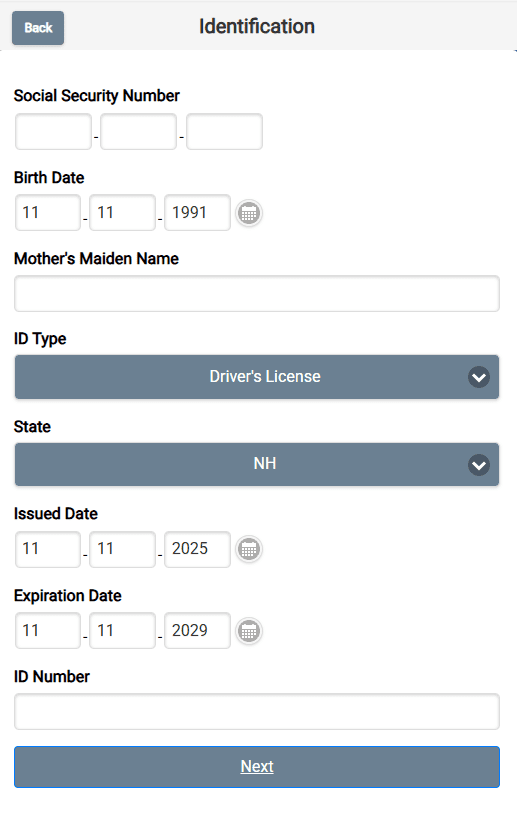

Step 8

Enter additional identification information and click “Next”

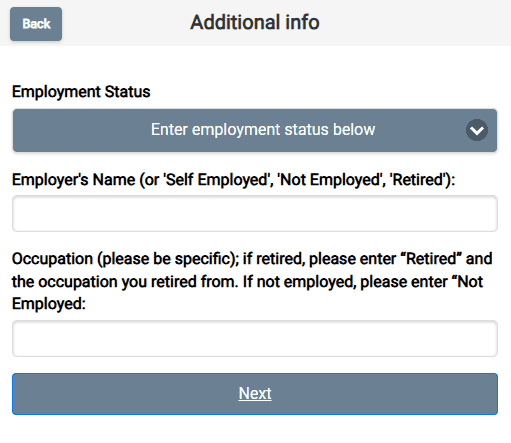

Step 9

Enter your employment details and click “Next”

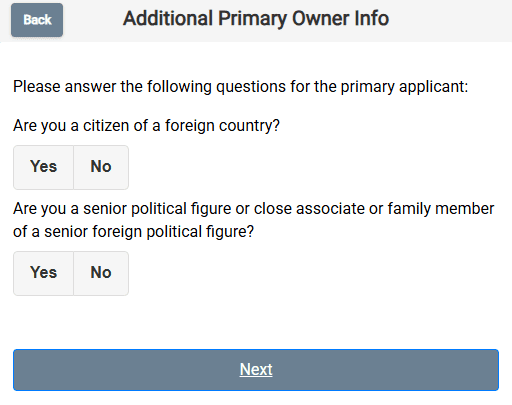

Step 10

Answer the additional questions and click “Next”

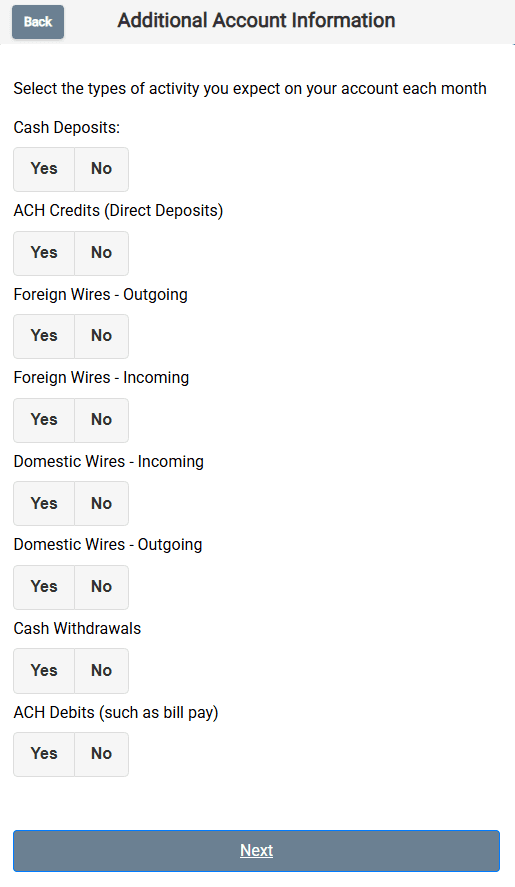

Step 11

Answer the additional account information questions and click “Next”

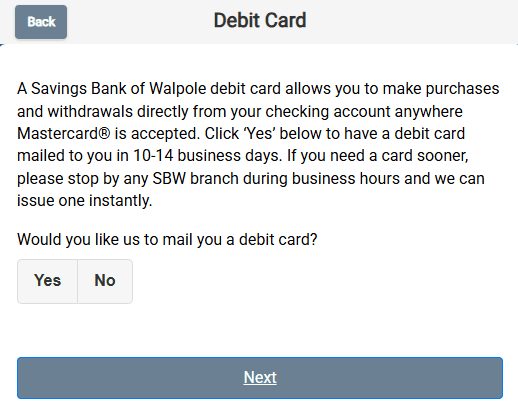

Step 12

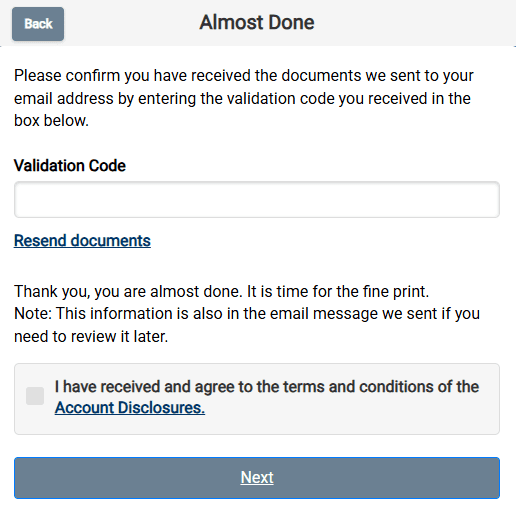

Step 13

Enter the code you received to your email in Step 5, check the box, and click “Next”

Step 14

Congrats! You’ve completed the sign-up process. Your application might need to go through an internal review; if it does, we will reach out to discuss your application. However, if you’ve been approved, you can move forward and fund your account.