Savings Bank of Walpole:

A Legacy of Community Banking

1875

Chartered in the State of NH and open for business as Savings Bank of Walpole.

Around this time, there were 349 State Banks and 1,294 National Banks in the USA.

1892

Westminster Street branch (now called "The Village Branch") in Walpole opens. Our first branch!

1896

The only bank in Cheshire County to survive "The Panic of 1896."

While many banks closed their doors, SBW weathered the storm and kept serving the community.

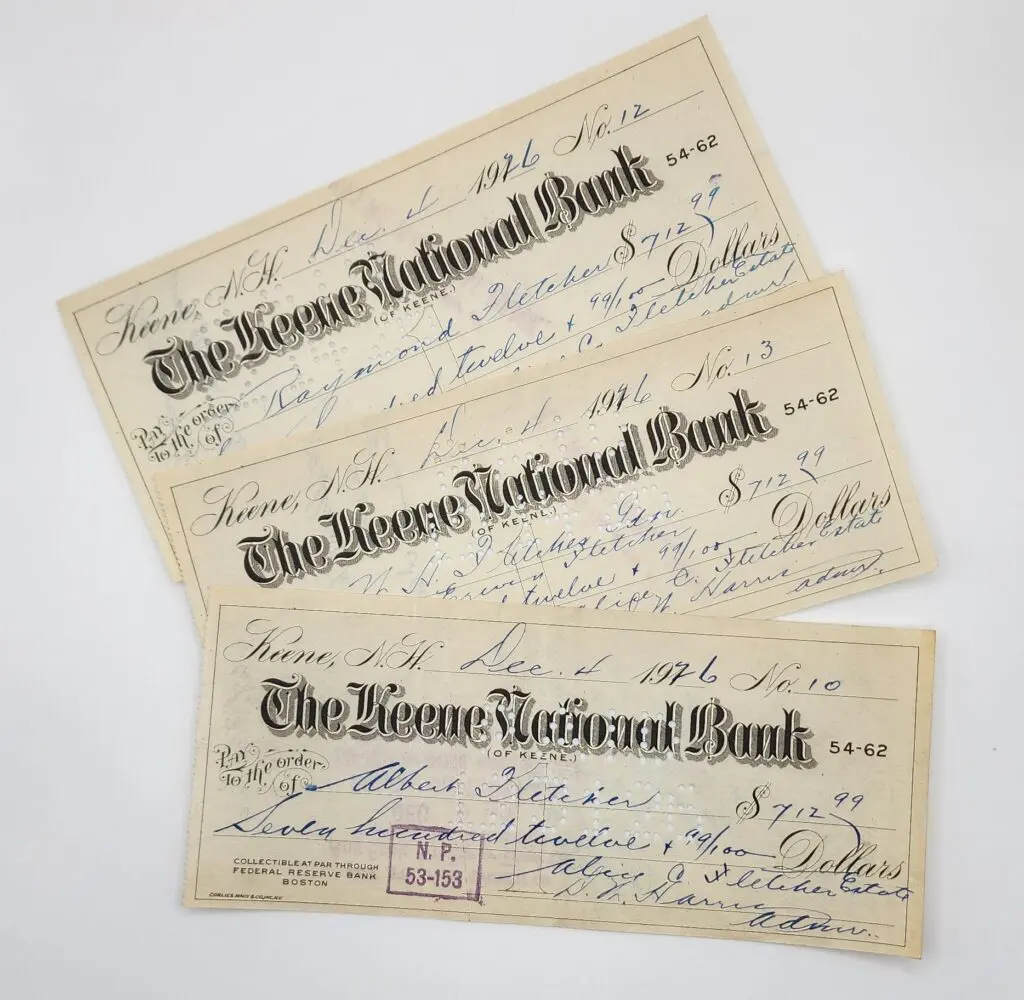

1900

Checks become a more common means of payment.

Banking convenience takes its first major step forward.

1902

Savings banks are federally recognized by the American Banking Association (ABA).

National recognition, local commitment. ABA also celebrates their 150th Anniversary this year!

1913

Federal Reserve System is established, giving banks a much needed centralized system to operate from.

1929

Stock market crashes—marks the beginning of the Great Depression.

SBW stood by the community when it needed us most.

1930

Total assets reach $1,461,000.

Growing steadily alongside the community we serve.

1952

Credit cards are established nationwide.

Changing the way customers managed their finances.

1964

Total assets reach $15,029,432.

Steady growth through the decades.

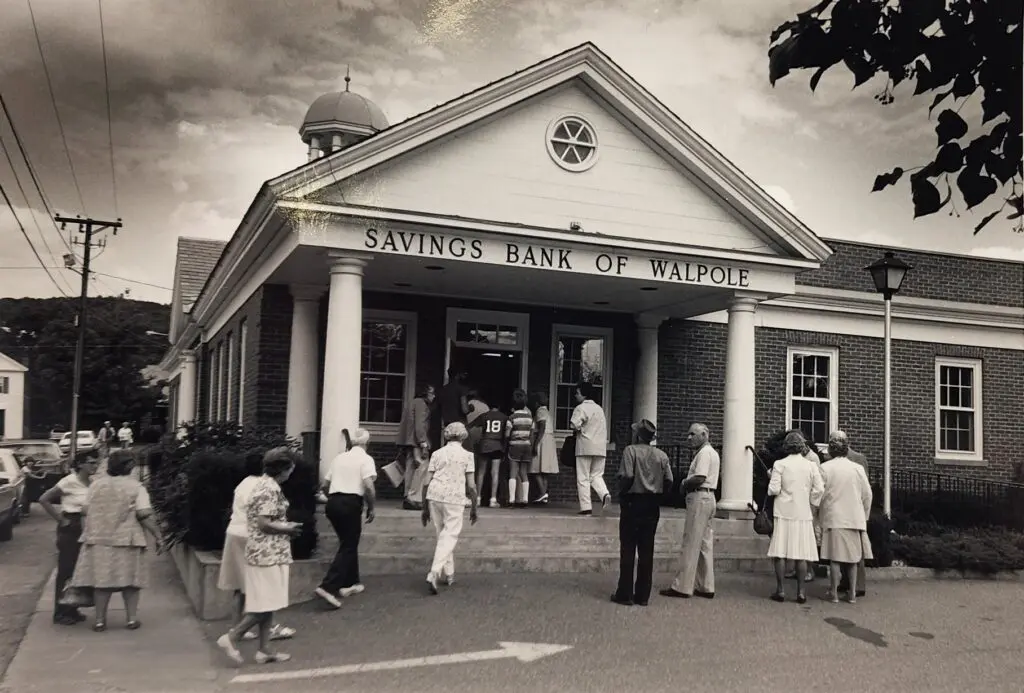

1975

Savings Bank of Walpole celebrates its 100th Anniversary.

A full century of community banking.

1975

First ATM, "The Walpole 25 Hours Banker – A Money Machine," installed at the Walpole branch.

Bold of us to add an extra hour to the day. And yes, the hairstyles were just as bold!

1990

IGA partners with SBW, becoming the first grocery store in NH to offer a bank card.

Blending banking and convenience.

1990

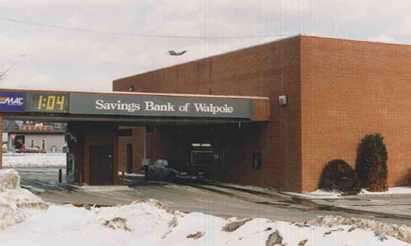

Grand Opening of North Meadow Plaza branch in Walpole. Our second branch!

Expanding our footprint in the Greater Falls area.

1990

A first in our region: Two competitor banks merge as First Cheshire Bank on Main Street in Keene is purchased by First NH Bank.

Reflecting industry shifts in community banking.

1992

Savings Bank of Walpole opens a new branch in Riverside Plaza, Keene. Our 3rd branch!

Expanding to the “big city!”

1996

walpolebank.com goes live on the "World Wide Web."

Back when screeching dial-up tones were music to our ears!

1996

Bank-By-Phone is introduced.

Banking convenience in the palm of your hand (although attached by a long, curly cord).

2000

New SBW branch opens on West Street, Keene (Riverside Plaza branch closes).

A shift to meet changing traffic patterns and make banking more convenient in Keene.

2000

SBW Internet Banking launched.

Full-featured banking from home became a reality.

2001

Marlboro Street branch opens in Keene, making our 4th branch in the Monadnock Region.

Continuing to expand to meet demand in the Keene area.

2007

Start of the housing collapse and recession.

Due to our local focus and commitment, SBW remained resilient during economic uncertainty.

2008

U.S. Government launches TARP (Troubled Asset Relief Program), which was established to stabilize the US financial system and restart economic growth. This was not needed at SBW due to excellent credit quality.

While many banks needed help, SBW’s sound lending practices meant we stood strong on our own.

2016

After more big-bank mergers, SBW becomes the only bank still headquartered in Cheshire County. Total Assets of $361,000,000.

Proud to remain locally owned and operated.

2017

Our 5th branch opens at 817 Court Street, Keene.

Expanding our services for Keene residents.

2018

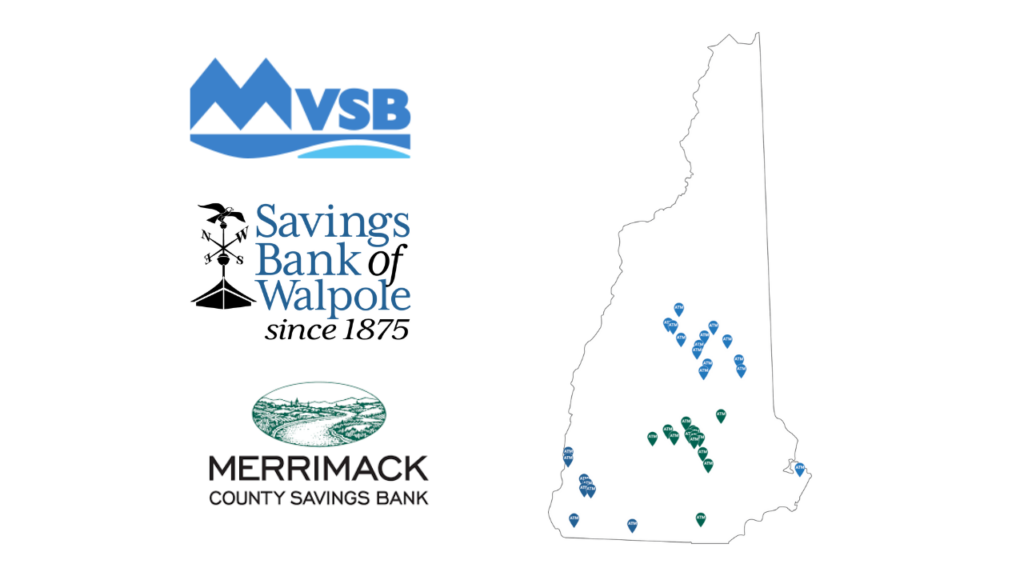

Affiliation with NH Mutual Bancorp becomes effective.

Same bank, same people, same values—stronger together.

2019

SBW Wealth Management becomes NHTrust.

Strengthening our financial services for customers.

2020

Despite a global COVID-19 pandemic, SBW thrives—achieving record growth to total assets of $555,000,000 while providing vital community support.

During the pandemic, we prioritized what mattered most: Keeping our customers and community safe and supported.

2021

SBW opens its 6th branch – this time in Winchester.

Expanding to serve a community in need of a bank due to their only bank closing.

2021

New NHMB administrative office on Kit Street in Keene

Supporting SBW and our sister banks from a single location in Keene.

2022

Over 40% of local SBW employees serve on nonprofit boards.

Giving back is who we are.

2022

Total Assets surpass $700,000,000 in July.

2023

SBW opens its seventh branch, this time in Rindge.

Expanding our commitment to the Monadnock Region.

2024

Named a "Best Bank to Work For in the U.S." by American Banker magazine for the 8th consecutive year.

Eight years running—because our people make all the difference.

2024

Ended the year with assets of $790 million.

Reflecting steady and responsible growth.

2025

Celebrating 150 years of serving the Monadnock Region.

150 years old… and we’re just getting started.