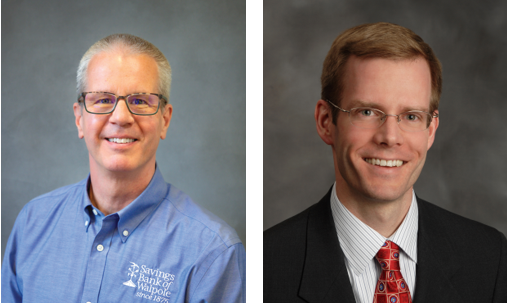

Welcome Back Chris Kebalka

Savings Bank of Walpole (SBW) is pleased to announce the return of Chris Kebalka as Senior Vice President, Commercial Loan Officer. Chris rejoins the Bank with over 13 years of experience at SBW and a proven track record of fostering strong commercial relationships, delivering results, and contributing as a trusted team member. In 2024, Chris […]