Our Cash Management services will feature new updates mid-Fall—designed to give you more flexibility, control, and efficiency in managing your business finances.

Here’s what you can expect:

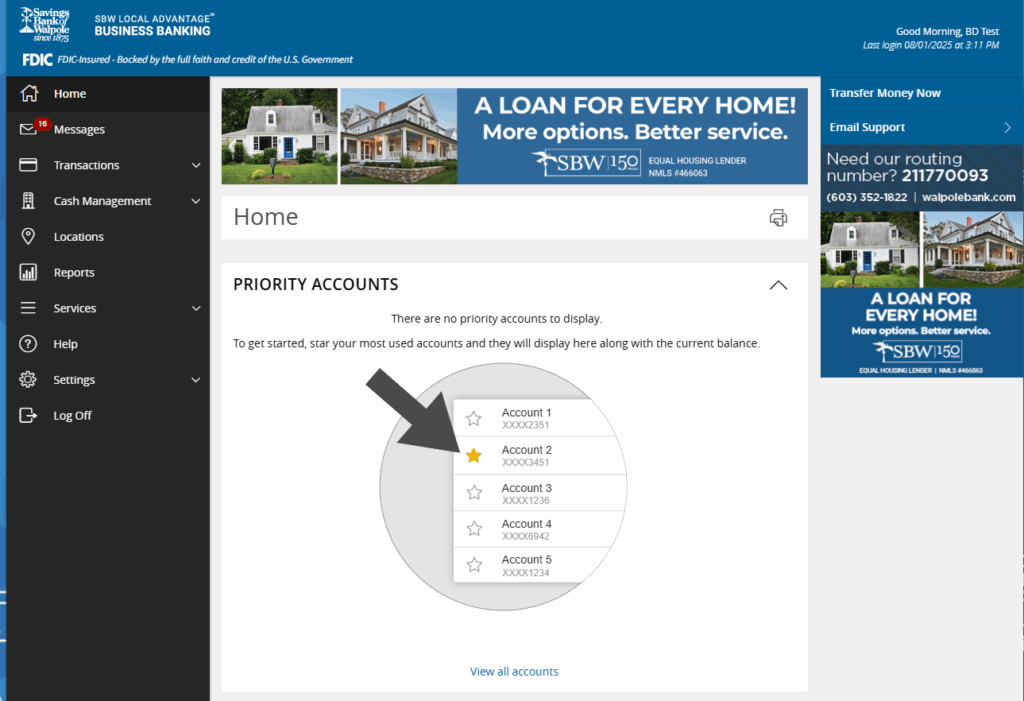

- Customizable Commercial Dashboard – Select and organize your priority accounts, set nicknames, and choose your preferred balance view.

Step 1: Select View All accounts located at the bottom of the screen

Step 2: Star the accounts you want to view on “Priority Account” Screen

Step 3: Select Home to view the Priority Account Screen. You can make edits to the priority account screen at any time, by selecting View All Accounts at the bottom of the screen.

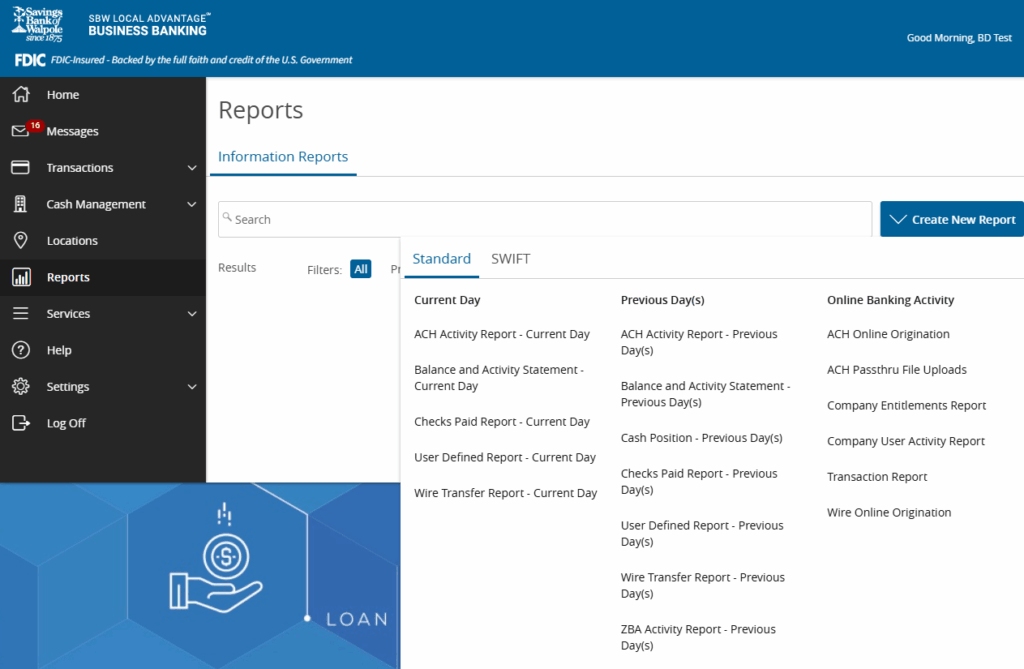

- New Reporting – Customize, schedule and download reports in BAI, CSV and PDF formats. Standard reports include: Account Activity, ACH Activity, Cash Position, Company Entitlements, Outgoing Wires, Transactions and User Activity. Reports can be set as private or shared with any other users in the same role.

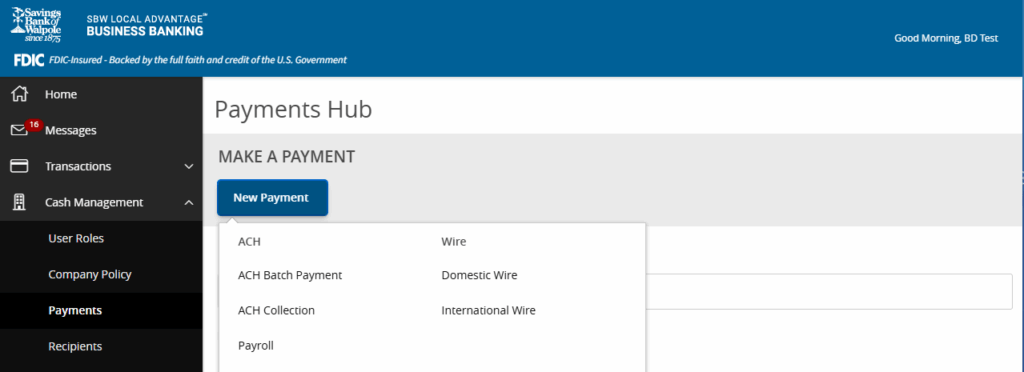

- ACH Recipient Upload from Batch Payments – Upload a NACHA-formatted file containing payment recipient information to create new recipient records, and update existing recipient records when new ACH batch payments are uploaded (ACH payments, collections, payroll)

- Multi-Account Transfers and Multi-Wires – Create, schedule, and manage multiple internal transfers (up to 35) or wire transfers (up to 20 domestic and 20 international) from a single page. Save sets of transfers and wires as templates to use for future transactions. A single batch ID is linked to each batch to streamline approval and reconciliation. Please note: transactions are processed in the order listed (top to bottom).

- Batched Wire Uploads – Import a CSV file including multiple domestic or international wires, replacing the need to manually key in the information. A single batch ID is linked to each batch to streamline approval and reconciliation.

- International Wire Recipient Bank Lookup – In addition to domestic lookups for recipient banks, search for and pre-fill international recipient bank information by entering the financial institution name or routing number. Intermediaries do not prefill, so be sure to gather this information if needed to ensure appropriate routing.

- Recipient Approvals – Enable approvals for new or modified payment recipients to mitigate fraud and ensure additions and changes are carefully vetted. This optional setting must be turned on by us, so please reach out if you’d like this enabled. We highly recommend it.

If you have questions or want help exploring what’s new, our team is happy to assist you.